As we roll into mid-November 2022, people everywhere are preparing themselves for one of the most popular sporting events in the world. The World Cup begins in only a matter of a few days, and the competition looks fierce.

The buzz around the world’s most popular sport proves, as always, to be about more than just athletic prowess. As with so many things, the management of these teams — and the egos that come with them — elicit comparisons to business and leadership. Reams of paper have been consumed with people opining about the success shown on the field offering valuable insights. Even the high-minded of the commentariat get caught up every so often in the comparison.

Sport As Allegory

In many ways, the quadrennial competition serves as a potent metaphor for the business world. Just as the brackets weed out lesser teams through wins and losses and the better, more well-managed teams typically coming out on top, so does the market provide a space of sorts where competition thrives. Teams win, teams lose, and sometimes the market even cleanses itself every so often, winnowing down the viable projects left in the space through sheer attrition, similar to a tournament.

The drama in which fans revel on the field can be seen in the market as well, so the unexpected often happens and the outcomes are never guaranteed. Often, the favored sides end up failing, falling apart at the absolute most critical point. Just as few people ever expected Germany to absolutely smash World Cup hosts Brazil in 2014, so too does the economy appear strongest right before it falls. Unfortunately, though, the metaphor wears thin beyond that.

In many other ways, sport serves us poorly as a metaphor from which to glean any solid lessons. In sports, the rules are all known and agreed upon by everyone involved, and participants all expect a certain modicum of behavior. The market provides something much less structured. This holds true especially for the digital asset space, where the rules, expectations, and best practices remain in flux. With very little consistency from one jurisdiction to the next, the “game” can change just as abruptly depending on where it gets played.

An Entirely Different Game

As matters stand currently here in the digital asset space, the rules simply do not really exist. Projects primarily have been left to their own recognizance. Not only have many actors in the sector eschewed the norms and practices of traditional regulated markets, many have demonstrated a remarkable amount of bad faith. It is not so much that they broke laws as they breached trust.

Case in point, we recently covered the sudden and precipitous collapse of blockchain industry giant FTX. With over 100 associated companies and projects simply evaporating almost overnight, the effect was immediate, abrupt, and violent. We have our heel turn in the babyfaced Sam Bankman-Fried, now amusingly referred to as Scam Bankster Fraud by cheekier observers. The supposed wunderkind of the cryptocurrency world proved that Wall Street holds no monopoly on generating crooks. If anything, that ignominious failure comes across more as fraudulent melodrama than fair play. While regrettable, with so few rules of the game and no referee, and incentives for malfeasance abounding, all is not lost.

While the painful FTX collapse will hurt bottom lines, wallets, and lives alike, ultimately the uncovering and cauterizing of the rot will strengthen the space, and the projects left alive and active will return stronger and better. Bad actors are getting flushed out, and the strong will survive. It happened during the last bear market, as well as the one before it. We find the cycle repeating itself now, similar to the past.

The main differences this time are of scale and attention. The volume of value and public awareness of the space have thrust the problems directly into the light of public scrutiny, to the point where people have begun to pay attention. Yet even as we witness one of the darkest times in this still-nascent industry, the promise of tomorrow still points our attention to the horizon.

The New Rules of the Game

Make no mistake, though. Regulations are on that horizon. While the recently aborted Red Wave in the United States all but guarantees a fair amount of political and legislative gridlock for the foreseeable future, the severity and seriousness of recent events may create sufficient bipartisan support for comprehensive regulation that will then likely become the standard for the rest of the world.

Regulations represent only one major factor. At the moment, despite recent inflation numbers being less serious than anticipated, almost 92% of active investors recently polled expect stagflation to become reality. Moreover, with the Federal Reserve leading the way and calling the global monetary tune for so much of the rest of the world, they will likely hike rates to at least 5%, holding it there for as long as a year or more afterwards.

To put it bluntly, we have no idea how these recent events will affect this sector. However, we can pretty safely assume that the fallout probably will not endear it to many potential newcomers for a while yet to come. Still, the timing could not have been more propitious for Ghost Trader.

The Dark Horse

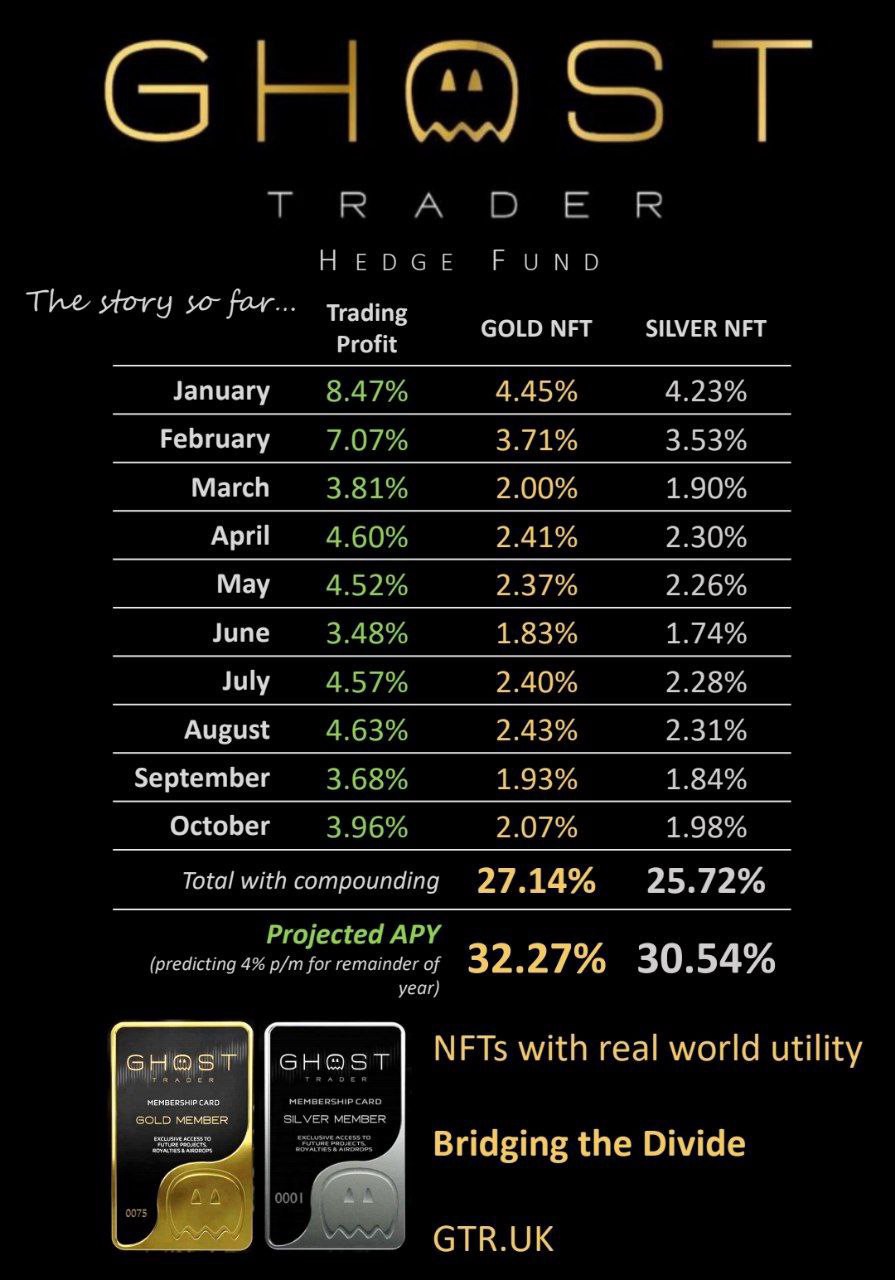

Ghost Trader has maintained a remarkable track record of consistency for almost an entire year, while working to elevate the entire broader DeFi community. Because our project straddles the two worlds of traditional and decentralized finance, our team abides by best practices to attenuate risk and ensure the success of our contributors. Rather than making outlandish claims or becoming embroiled with the team sport of politics, the team focuses on adhering to our official remit.

On an important related note, the Ghost Trader team will never rehypothecate any assets provided by contributors. If you dig into the FTX scandal, that practice played an enormous role in that gnarl. Unlike so many other yield-maximizing operations in this space, Ghost Trader does not need to take a chance on the added and unpredictable risk of what amounts to privatized fractionalization. In so many ways, this project rests on a boring but predictable foundation of solid fundamentals and remarkable transparency not typically seen in this space, or in traditional finance either.

While the team makes no guarantees of performance, we remain focused on realistic and achievable goals, prioritizing the interests of our contributors over all other concerns. Join us. And enjoy the World Cup — and a stress-free bear market — with all of us at Ghost Trader.

Please be sure to stay tuned to our social media outlets moving forward for updates and news of the Ghost Trader project. We invite you to check out our official Ghost Trader website, join us either on Telegram or Discord, follow us on Twitter and LinkedIn, and be sure to check out the newest podcast episode, with our very own Eddie on the ones and twos, interviewing both the Ghost Trader himself and our new trader as well. It can be found here.