All too often in the digital asset space, so many people get caught up in the excitement, the thrill of the market and space both. The technological novelty and the promise of easy money lures in so many, like a digital market mousetrap. Once involved, many become accustomed to the constant vacillation from exhilaration to dejection and back again. The excitement keeps them occupied, and the hopium from all of the volatility they experience keeps them from abandoning the space until, eventually, many capitulate at the worst possible moment.

When the dust finally clears, most end up worse off than they started. That is no exaggeration. According to a recent study, approximately 80 percent of global cryptocurrency investors have likely lost money on their holdings. This cycle has proven itself time and again with each successive rotation of the market.

The Sad Facts

That fact should not surprise anyone. Since Bitcoin’s inception, more than 21,000 different cryptocurrencies have launched, following in Bitcoin’s footsteps. Most of them have failed — as in, they have gone belly up. According to a recent study conducted by the Bank for International Settlements (BIS) and in collaboration with IntoTheBlock and CryptoCompare, “back-of-the-envelope calculations suggest that around three-quarters of users have lost money on their bitcoin investments.”

For those unaware, Bitcoin currently commands a little over 41% of the entire digital asset market cap. It stands to reason that if most retail buyers of cryptocurrencies lost money buying Bitcoin — the figurative juggernaut of the space — then those who bought any of the other digital assets have also lost money. In fact, they have probably lost a significantly larger percentage than if they had just bought Bitcoin.

This tracks further when we consider who tends to buy those altcoins — retail buyers with either a high risk tolerance, a severe lack of market knowledge, or both. The author speaks from personal experience. Here is the dirty little secret about the altcoin market, one that surely will upset many. The truth will hit too close to home. Very few people who participate in that sector possess much of a grasp about the technology, and just as few understand basic market fundamentals. At all. By and large, most altcoin market participants have little clue about what goes on. So of course they get wrecked.

The Hard Truth

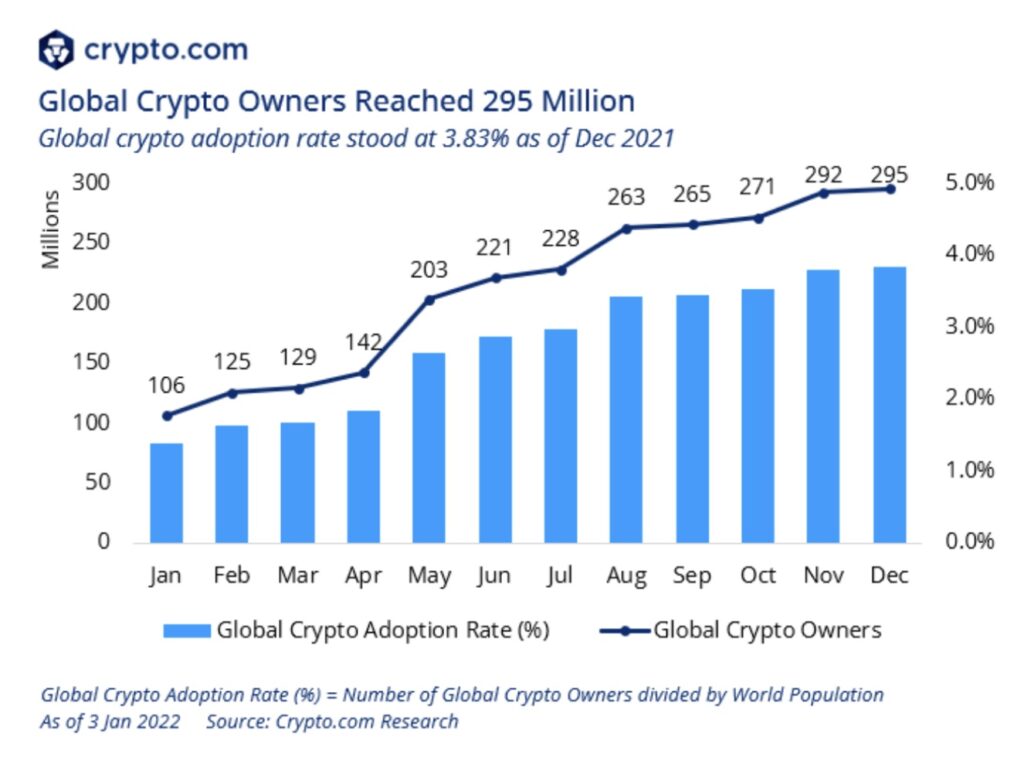

Consider this. Most people who have gotten into the digital asset market at all have entered since the beginning of 2021, after the major run-up in the market. We know this because we can track general global adoption, on-chain.

The sell-off that began in May 2021 caught most of the diamondhanded, laser-eyed lemmings — author included. Unless you were smart (or fortunate) enough to have entered prior to that initial market deflation, and you managed to avoid getting suckered into the relief rally back to $69k, you most likely lost money.

The Adoption Curve, By The Numbers

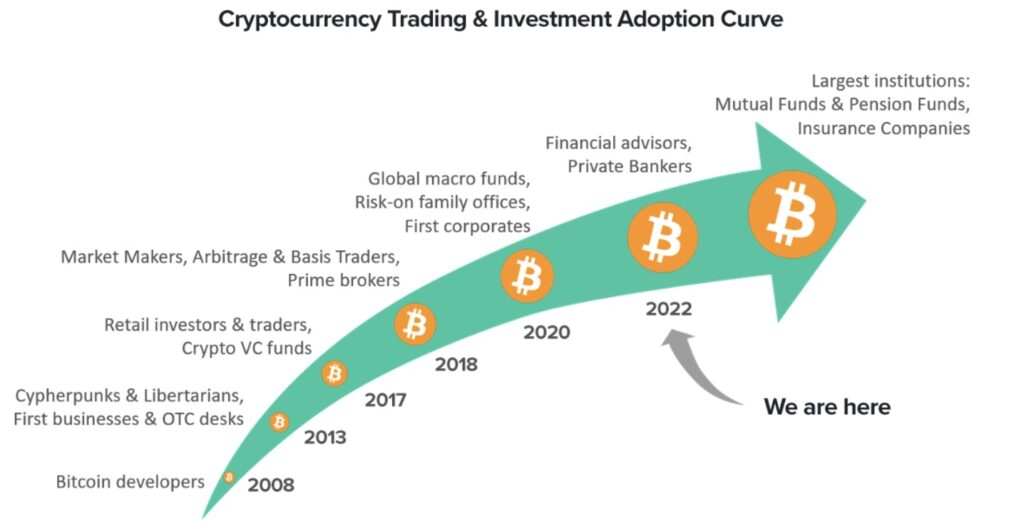

The so-called “digital asset adoption curve” gives us a decent indicator of the progress toward mainstream adoption for digital assets. The curve denotes the different user segments. They range from the early adopters like Bitcoin developers and digital purists, to the laggards, represented by large, established institutional actors like wealth managers. More retail-oriented actors such as mutual funds, pension funds, and retail banking bring up the rear, and will naturally provide easy on-ramps for significantly broader retail adoption.

*Chart taken from www.finoa.io

To put this all into perspective, according to www.crypto.com, perhaps as many as ten percent (10%) of global internet users own some form of cryptocurrency. That comes to roughly between 300–500M digital asset owners worldwide. That means we have scarcely scratched the surface of what to expect in terms of digital asset growth. It also means that the number of people who will end up losing money will grow exponentially.

The largest, fastest growth in those numbers occurred precisely when the market began to become frothy and overheated with the most recent bull cycle — November 2020 to July 2021. According to the chart linked here, the number of Bitcoin block explorer Blockchain.com wallet users worldwide increased from 55 to 75M.

Shocking to those on the outside looking in, but almost certainly understating the facts, these numbers seem to track with the experiences of most people currently active in the space. Since the first Bitcoin block got minted, prices for cryptocurrencies have undergone multiple boom-bust cycles, with new projects entering the market with each new cycle. Each new cycle has ushered in a new cohort of greenhorn digital asset investors and collectors, slowly growing the number of people involved.

Up to this point, nothing indicates a deviation from this trend. The market always attracts those least able to lose at the most disadvantageous points in the market cycle. The more aggressively volatile and easily accessible a given market, the more people get punished for their greed. This trend has proven predictable as long as markets have existed. The only solution, unfortunately, is experience. Veterans eventually learn that chasing the newest, shiniest thing typically proves itself a losing proposition. The lure of the so-called “degen” approach serves as a siren song for most people. Eventually, though, people either get smarter or get washed out.

Ghost Trader — The Solution For Newbies and Veterans Alike

Luckily for us, all hope is not yet lost. We can avoid the pitfalls and traps, if we choose to do so. Ghost Trader has managed to bring real market expertise, reliable passive income opportunities, and an impressive track record to the game. No longer must we reconcile ourselves to poor performance and outsized risk. Instead, we can avail ourselves of the skills, expertise, and experience of one of the most dynamic trading teams currently operating in the market.

Moreover, we have the opportunity to engage in real, self-directed wealth management that previously remained the rare privilege of the elite. This manner of opportunity usually never comes around for those of us who trade with assets in the hundreds, or even thousands of dollars, pounds, euros, etc. Ghost Trader provides the sort of top-level tools, performance, and hands-off expert proficiency that lends itself to sovereign wealth funds and bankers.

Pending Ethereum Migration

As part of the next phase of development and in the spirit of bridging the divide, Ghost Trader will be moving from the Binance Smart Chain network to the Ethereum network by the end of this month, January 2023. The team is excited for this next phase in the project and looks forward to engaging with the Ghost Trader community in support of the move to Ethereum.

Not only will the move provide the team greater access to a broad palette of significantly better tools with which to improve the functionality of smart contracts and infrastructure within the Ghost Trader ecosystem itself, these new capabilities will allow for significant upgrades in functionality and utility for our contributors.

Join us now. This is still only the beginning.

Please be sure to stay tuned to our social media outlets moving forward for updates and news of the Ghost Trader project. We invite you to check out our official Ghost Trader website, join us either on Telegram or Discord, follow us on Twitter and LinkedIn, and be sure to check out the podcast found here.