Ghost Trader at AIM Summit 21–22 November 2022

Jumeirah Emirates Towers DIFC, Dubai

Submitted by General State

Recently, the Ghost Trader team (GTR) took the opportunity to share our work with others in the industry. Held in Dubai, the Leading Alternative Investment Management Summit provided a perfect setting to put our work on display and get a much better understanding of the wider industry.

Occasions such as these afford the project many opportunities to share our vision and our platform with the broader world. These industry conclaves tend to attract people from overlapping, associated, and tangential market niches. Indeed, attendees to these types of events often have not yet begun operating in the digital asset space.

The team values innovation and disruption as a means of facilitating progress, and these professional conferences provide the team the ability to assess our place in the industry, as well as hone our own ideas. This event welcomed a variety of companies and projects, many of which came together to build relationships and deepen professional networks.

Led by our co-founder, Sir Ghost Trader himself, with CryptoHatts and General State stalking the flanks, the GTR team presented themselves with aplomb. The mission was to understand our competition, first and foremost. The team also sought to identify areas of expertise or value amongst fellow attendees. This platform offered the opportunity to mix and socialize, networking at its finest. The packed schedule of fireside chats and paneled discussions provided ample opportunity to rub elbows with many of the so-called movers and shakers of the industry.

The first day of the conference began with a more traditional discussion-oriented event covering familiar-sounding topics to the wider investor. Stagflation, geoeconomics, soft landings, and private equity dominated the conversation, with topics focusing on the “Green” market taking center stage. Most investment houses and individuals have begun to recognize its importance as a fast growing and critical sector of interest.

While incredibly interesting from a personal perspective, the discussions on that LED-soaked stage did not offer the sort of greater opportunities our team sought to identify and engage. Unique opportunities rarely make themselves known under the klieg lights illuminating the heavyweight industry speakers. The real business of networking of this type of event usually occurs out amongst the bustle by the canapes and standing tables, easy places to meet people, huddle round, and exchange pleasantries and business cards.

After a couple of hours, the other attendees with whom the team interacted were all very much of similar ilk, likewise seeking other serious, seasoned business professionals. Our intrepid trio even encountered a handful of other blockchain industry representatives, although their faces betrayed them, exhibiting a commonly shared, exhausted look to their faces. Their expressions tended predictably to turn dour as the conversations inevitably turned to world economics and the fallout from the recent FTX debacle.

Interestingly, the general consensus impression held that most traditional investment companies had already primed their techniques to take advantage of the FTX disaster as their go-to bogeyman to instill fear in their target markets. Also abundantly clear, these more traditional — that is to say non-blockchain — finance companies demonstrated a profound, almost complete unfamiliarity with the blockchain space.

With such a general deficiency of knowledge on their part for how our space worked, maintaining their attention initially proved challenging. Nevertheless, conversations continued and persisted. As the team began directly comparing the more mainstream stable of alternative investment structures and profits with GTR’s own, the responses became more marked. Many raised eyebrows resulted from the discussions. Clearly, GTR was a different sort of animal altogether. Moreover, it became increasingly clear that the project had garnered some attention. No one else had ever considered trying to bridge the divide between TradFi and DeFi.

After these initial discussions, the team decided to call in the heavies, our Ghost Raiders team, to engage in a promotional gambit. Having already met the founder of the event, CryptoHatts took this opportunity to increase our exposure. Since the event’s founder already had familiarity with our project, this was our moment to stand out amongst the crowd. Now was the time to leverage our networking, increasing our visibility amongst the AIM contingent.

Tweet fired. Raiders deployed. Success achieved.

The second day of the summit proved to be GTR’s bread and butter. The event hosted numerous panel discussions, covering topics spanning from Proof-Of-Work mining to bridging existing finance with Web3.0, and from impending regulation to the mental health impact of market volatility. These panels offered the team ample chances to shine. Over cups of English breakfast tea, croissants, and pain au chocolat, the team planned their approach to capture the attention of several delegates for key conversations.

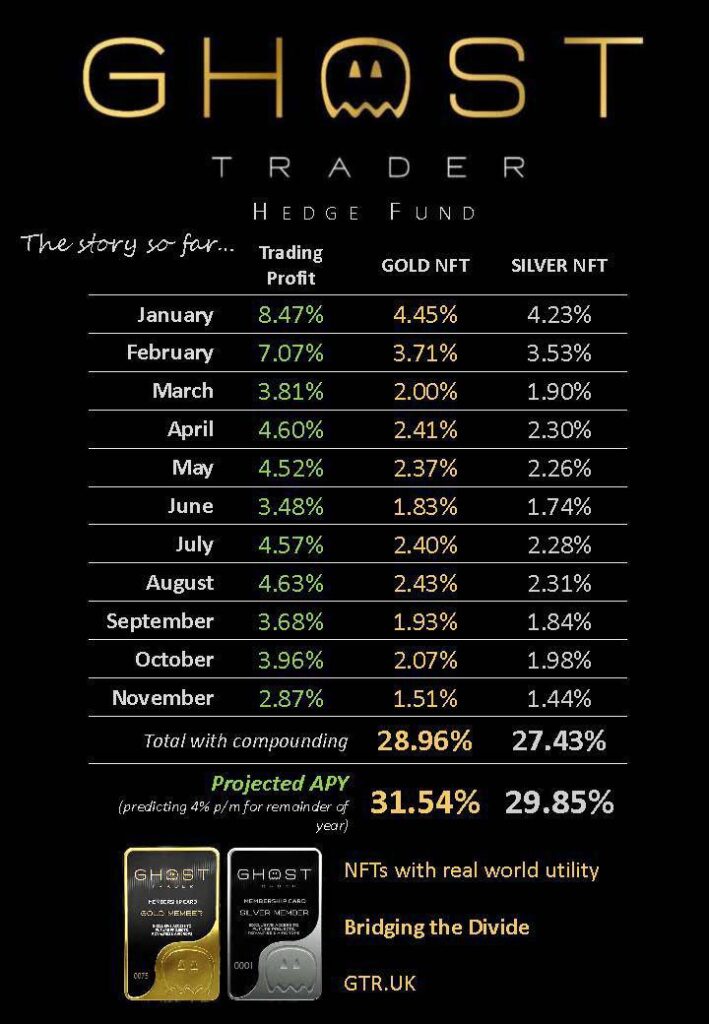

The team set themselves to work, championing the performance GTR. People were genuinely impressed that a fledgling company not yet officially a year old had managed to outperform practically everything else in the market. Twelve green candle months since inception sounds impressive under any circumstance, but especially so while the rest of the market bled itself white.

Our incredible performance caused people to take serious notice, and provided openings to discuss our innovative use of NFTs. No one had seen such a unique and functional utility for NFTs. More than a few times, our team heard some permutation on the sentiment, “Why has no one else thought of this?” Between our unparalleled, market-breaking performance and our novel user case, conversations with exchanges, venture capitalists and fellow hedge fund CEOs proved far easier than initially anticipated. By midway through day two, the team had established that GTR was the only project that offered so many unique features to our contributors, especially when compared to other hedge fund offerings.

The pitch was easy:

• NFTs that reflect individual balances/contributions and ledger all transactions

• Treasury held off chain, therefore not exposed to market volatility/exchange collapse

• Traditional trading methods not reliant on maintaining algorithmic bot performance

• 3x organic pot growth since inception, reflecting our hands-on policy of onboarding and educating contributors

• 40% projected company profits this calendar year

Over the course of the summit, the team encountered a swathe of bot-initiated trading funds. While these projects provided the most directly comparable line of competition, none offered the performance or the utility GTR provides. While GTR will never dismiss the use of automated trading as a strategy, that approach runs contrary to the team’s approach and philosophy. While such tools may play a small role further down the line, it will not be an integral part of our strategy.

GTR displayed this year just how impactful and effective our trading techniques are. Our team believes that active risk management always outperforms technology-based formula trading. Strategic, well-managed methods have been the foundation and very lifeblood of Sir Ghost Trader’s multi-decade reputation as one of the most reliable traders in the world. This approach, fused with the cutting-edge technology that blockchain innovation provides, makes GTR an incredibly unique alternative to potential investors. This distinctive merging of traditional financial skill and expertise with 21st century technology set the project apart from all others, and put the rest of the summit attendees on notice.

By the close of the second day of the conference, the consensus response from other attendees made it abundantly clear that exciting times lie ahead for GTR. With a full year of unbroken growth, an unrivaled team, and the most supportive community in the space, GTR will continue to venture forward at speed into our second year.

We are the Innovators. We are the Mavericks. We are Ghost Trader.

This is only the beginning.