The world of decentralized finance has proven to be a fertile area for innovation and development as of late. The tokenization of everything has not only continued unabated, despite the entire economy suffering a major systemic contraction. Even more, the rate of change has continued to increase, rather than diminishing.

One of the most active niches in the sector has been the yield generation sector. Over the last couple of years, the blockchain community has witnessed the proliferation of countless yield-based projects across the digital asset space. The list continues to grow almost daily, each with its own unique approach. They run the gamut from basic and straightforward to others significantly more byzantine.

Our Invitation

The Ghost Trader team takes yield very seriously. At the highest levels of finance, risk-managed yield is the name of the game. While we believe our project outshines every other comparable project in the space, taking our word for it would not constitute diligence on the part of our readers. We want everyone to know exactly how our project works. This space improves only through sterling transparency and outstanding performance. At Ghost Trader, we give you both.

We invite you to do your own research, starting at our official Ghost Trader website. You can also join us either on Telegram or Discord, follow us on Twitter and LinkedIn, and even listen to our podcast, found here. That way, you have many options for accessing the information germane to your research, up front.

Yield, The Oncoming Traffic

Despite the wide variety of yield projects that launch, their life cycles tend to follow a rather predictable, now-familiar trajectory. The more successful projects seem to get a ton of hype, and often even see some impressive early adoption growth — particularly if they manage to find amenable internet personalities to shill their projects.

Sometimes, these projects even manage to cobble together a few months of remarkable performance. Then, just as abruptly as they arrived on the market and built a following, their performance inevitably flags or something important gets disrupted. They either continue to putter along, waiting for the mercy of the market to put them out of their misery, or they collapse under a dark cloud of questions and allegations.

Leaving aside the scammers and fraudsters, of which there are tragically too many, even the serious projects lead by pure intentions fall short. These projects then must either alter their original fundamental value proposition to survive, or worse. Even many promising projects fail entirely.

No doubt the vast majority of these projects employ dedicated, trustworthy teams who work in good faith, trying to deliver real value to their communities. Some even manage to succeed at that task for a short while. Unfortunately, few have shown resilience or staying power, even when they end up performing as designed — if not expected.

Success or Failure — The Details Matter

The obvious question with which we are faced is as straightforward as it is difficult to answer. Put briefly, what is it about the serious projects that causes them to fail? Why do these projects tend to suffer such a high attrition rate?

Short of superficial comparisons, identifying a common trait or even a constellation of similar characteristics has proven elusive, but tends to come down to a couple of issues.

The first major problem is something that ought to be obvious to most, but too often gets ignored. If the project does not actually provide added value, that project will most likely eventually fail. This does not mean that a project cannot get off the ground, and even enjoy a short period of success so long as the market provides optimal conditions.

Unfortunately, as we have seen over the past eighteen months or so, relying on the market to provide optimal conditions seems foolish, particularly as the entire global economy appears to have entered a period of reorientation and reorganization.

Another major problem lies in these projects using their own token to remit rewards. Now, I understand why this may not matter to some, but the fact of the matter is that a yield project predicated upon its own token has the ability, and perhaps even the incentive, to manipulate their coin for the benefit of the project, rather than the benefit of its contributors. One cannot help but think of Richard Heart’s projects, for example.

One of the greatest problems lies in the policy of many of these projects to require extended capital lock-up periods. In fact, as we saw this problem come full circle recently with the failure of the project known as YieldNodes, when the project stopped all principal withdrawal altogether. For a much deeper dive into why that project failed, take a look at this article here.

There are certainly other factors, but these have proven thus far to be the most easily identifiable characteristics of a yield project that may very likely fail in the future.

Finally, Another Way

It should come as no surprise that the team at Ghost Trader does everything in its power to elevate the expectations of the space, as well as improve its success rate. So far, the team has made good on those efforts. Our success stems from how we do things differently, fundamentally, from the ground up. Our project has incorporated a number of different approaches and policies, critical aspects of our project that make success a much more likely outcome.

The first major difference is the most obvious. Rather than manipulating an internal tokenomic mechanic as the means of generating yield for holders, the Ghost Trader himself and his talented trading team generate yield organically by trading in the traditional finance markets. Whether through trading in ForEx, commodities, even market indices, Ghost Trader generates added value as the primary focus of the project, not as an afterthought. Yield only gets created when the Ghost Trader successfully performs.

Additionally, unlike other projects in the yield-generation field, GTR remits rewards to contributors in the form of stablecoin, specifically BUSD. That means that rewards do not have the additional volatility risk of projects that pay yield rewards in the form of native coins. There are no incentives to undercut the underlying value or inflate away the value of our token just to make the yield stream continue. Gains in the traditional market power the entire GTR ecosystem.

Lastly, Ghost Trader does not limit contributors’ access to their capital. The capital provides liquidity to the trading team. The trading team uses that liquidity to generate yield, but the team makes withdrawals available on a regular schedule every month. From the moment of inception, Ghost Trader blazed an entirely new trail across the digital asset space. The team has been pioneering a new and novel use case for blockchain technology in the digital asset space from day one. When the project began, to our knowledge GTR was one of the first projects — if not the absolute first — to use NFT technology as the basis for an innovative new class of financial instrument. It is precisely that novel use of NFTs that allows us the ability to provide contributors access to their contributions, right inside our custom DApp. Our policy and our innovation give our contributors the peace of mind knowing that they have access to their capital.

The Differences Add Up

To put it bluntly, we are the light in the darkness of the current crypto winter. You do not have to subject yourself to the stresses and anxiety of volatile, unproven projects with questionable functionality. There is a better way, and that way is through GTR.

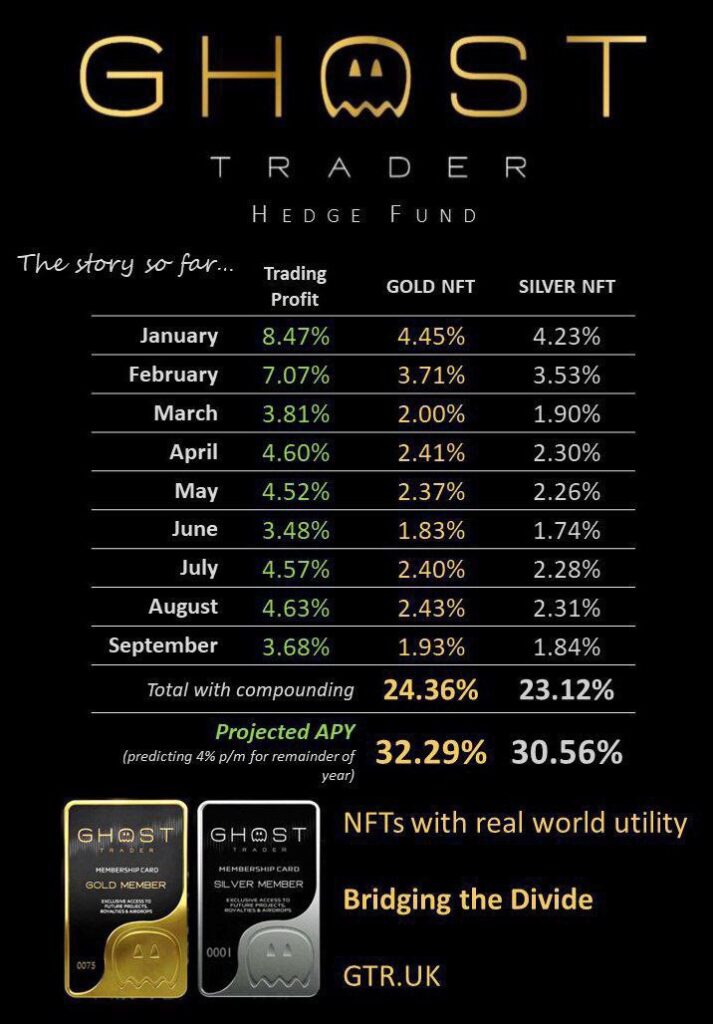

For 10 consecutive trading periods, reaching all the way back to November of 2021, our trading team has delivered market-beating rewards consistently. Not only have our contributors enjoyed the benefits of high yield, they have simultaneously enjoyed an unprecedented position of effective capital preservation. Rather than being victimized by the rampant inflation of the global economy, GTR contributors have managed to gained ground instead.

Despite the volatility of the digital asset market, even the GTR token itself has managed to hold its own against the rest of the market. And it has done so while consistently remitting a reliable reward stream — every month, like clockwork. The intelligent design of the project itself has instilled an immense deal of confidence in our community, and our community has been rewarded for their faith and support.

At GTR, we designed our project from the ground up specifically to help our contributors achieve a better life than they could otherwise. As time presses on and our string of successes continues unabated, we continue bridging the divide as we go. We welcome you to join us.