Inflation — it seems like all anyone hears about anymore on the retail news. The word itself tends to terrify economists, politicians, and laypeople alike. Inflation has a well-earned reputation for accompanying systemic financial and political instability, particularly over the past century. Indeed, the spectre of inflation has cast a long, dark shadow over the collective psyche of modern society. Numerous political movements and many elections have turned upon the issue of inflation. Recently it seems that we have entered one of those periods, and the descent has only just begun.

Inflation — A Primer

If you have some trouble understanding what inflation is, worry not. You definitely are not alone. The sad fact of the matter is that even many economists misunderstand its mechanics, its causes, and often its effects. However, one thing most people do understand is how inflation affects their lives. There is a certain visceral familiarity people who have lived through periods of high inflation always seem to possess.

As such, this article should by no means be mistaken as the definitive work, or even opinion, on the subject. Rather, take this as a way to familiarize yourself with the topic. Consider this your primer on the subject. The aim is to help provide some fundamental insight in order to enable the reader to understand the phenomenon a bit better. Hopefully, this information helps our community understand more of the world in which we operate, particularly from a practical planning perspective.

Inflation — What Is It?

Simply stated, inflation is the rate of the increase in prices for goods and services over a given period of time. Typically, governments do much of the work of collating and analyzing data to arrive at their official estimates as a broad economic indicator, the ones upon which they base economic policy. Governments typically need this sort of insight to plan policies around the overall increase in prices or the increase in the cost of living.

Researchers can impute discrete rates for certain goods, markets, regions — anything for which we can collect data. Regardless of the application, inflation indicates how much more expensive something has become over a certain period of time. For a deeper but still accessible discussion of how inflation gets measured, particularly the Consumer Price Index (CPI), please take a look here. For access to the British government’s Office for National Statistics, go here. For access to the US government’s Bureau of Labor Statistics (BLS) inflation calculator, follow the link here. Most governments have their own versions of government statistical bureaus, so keep that in mind if deeper information about your particular corner of the world interests you.

Inflation — The Current Numbers

To put inflation into the proper context, using the actual statistics will help us. In August, the CPI for urban dwellers increased 0.1 percent. Over the last 12 months, the CPI has risen a whopping 8.3 percent. Core inflation, the index for all goods and services except for food and energy, increased 0.6 percent in August, and was up 6.3 percent over the previous year.

Let us dissect these numbers a bit. While the rate of increase of headline inflation has begun to decline — owing primarily to the fall in energy prices — we have to see it officially peak. The trend indicates that we may be close, so that could be promising for consumers.

Inflation — The Ground Level Effects

For consumers, particularly those nearer the bottom of the income and wealth ladder, the volatility of food and energy prices can play havoc with their budgets. The aggressive price changes make planning difficult, if not impossible for many. Most people tend to pay a great deal of attention to the CPI for that very reason.

Core inflation gives us a clearer view of the state of the wider economy, though. It reflects the relationship between the prices for goods and services and consumer income. Core inflation effectively gives us a measure of consumer purchasing power. For example, if prices for goods and services increase over time while broad consumer income remains static, consumers end up with less purchasing power.

Getting down to brass tacks, whether we are discussing CPI or core numbers, the economy does not appear to be healthy. Even with the recent wage hikes, wages still have failed to keep pace with prices throughout the rest of the economy. In fact, the lack of wage growth over the past 4 decades has functioned as a brake on inflation, and only recently has that wage suppression trend changed.

Inflation — Why It Matters to You

When wages only rise 5% while food prices increase by more than twice that rate and energy prices increase by double THAT rate, problems tend to arise. No matter what, consumers will end up out of pocket by significant margins just to maintain their standard of living. This becomes a particularly painful proposition particularly for those finding themselves on a fixed budget, or if capital preservation is an important concern. That reality seems to have settled in for a longer duration than most have anticipated.

Despite several major central banks around the world hiking rates multiple times since March 2022, global interest rates still remain pretty low by historical standards. The average retail savings account only pays about 0.17 percent APY. That sort of anemic baseline yield on savings makes maintaining the purchasing power of one’s savings exceedingly difficult, if not downright impossible. Your deposits may be backed by governmental guarantees, but they only limit downside risk. They do nothing to help us maintain our purchasing power.

The Traditional Finance World’s Response

Traditional finance offerings beyond your local bank’s savings account fail to do much better. Forbes recently published a list of what their editorial board considers the best low risk alternative savings vehicles, and their suggestions did not exactly impress. This is not the space to take each one in detail at the moment, but please take a moment to read through Forbes’ article. It benefits us to quote the author’s caveat at length, though. It reads as follows:

“[W]hile these are low-risk investments, they aren’t no-risk investments. Unlike bank accounts, these products are not insured by the Federal Deposit Insurance Corp. (FDIC) — you can still lose money. That said, you may be willing to take on a little extra risk in exchange for higher rates of return from products that still offer great liquidity and ease of access.”

The following is Forbes’ suggested list:

- Treasury Notes, Treasury Bills and Treasury Bonds

- Corporate Bonds

- Money Market Mutual Funds

- Fixed Annuities

- Preferred Stocks

- Common Stocks that Pay Dividends

- Index Funds

The goal of any serious market participant worth their salt wants to maximize their upside potential while simultaneously minimizing any downside risk. Yet, tradeoffs exist between the two. To compound the problem, the treacherous market conditions complicate that delicate balancing act.

Even assuming someone does manage to make what would be considered traditionally as reasonably good choices, one last major impediment remains. The aforementioned systemic inflation absolutely eviscerates real purchasing power. Literally none of the above options provide anything close to sufficient returns to account for that silent killer. They represent something more akin to triage, the financial equivalent of a tourniquet to stem the proverbial bloodletting.

The Bottom Line

Clearly, traditional finance holds few answers for most of us. Sure, money market funds, annuities, government and high-grade corporate debt are some of the best low-risk, “higher-yield” tools on offer from TradFi.

The truth of the matter is that they simply do not measure up. Equities and index funds, fine in a stable and rising market, keep shedding value at such a rate that inflation actually represents a secondary risk. When maintaining one’s capital position becomes an impossibility, inflation becomes an afterthought.

A New Hope

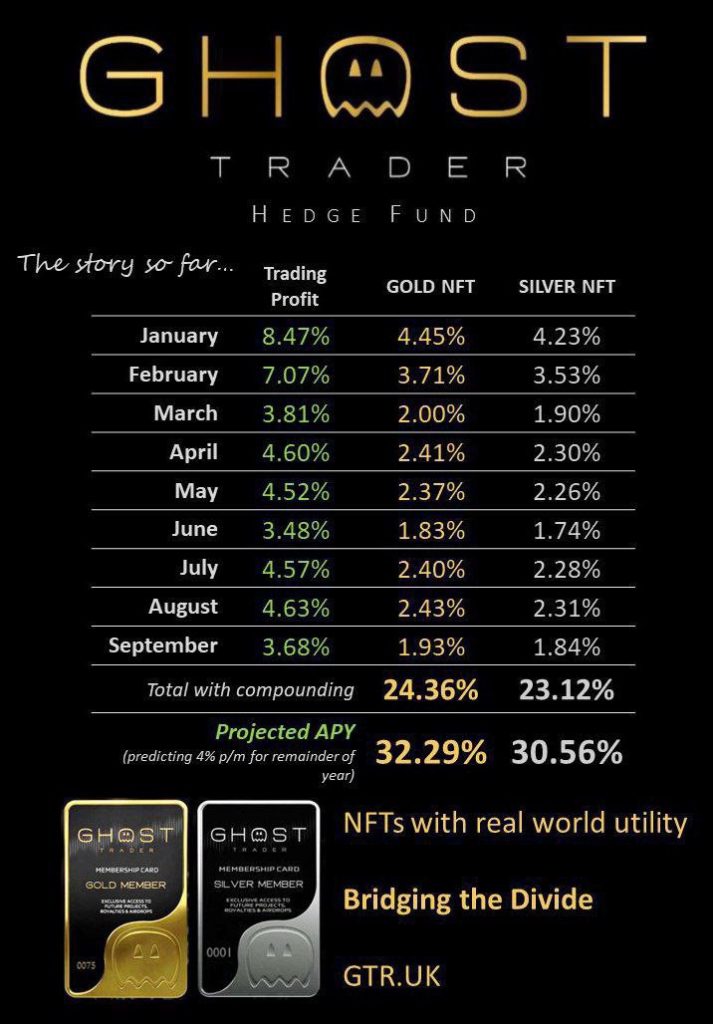

Believe it or not, there is a light in the darkness. You do not have to relegate yourself to a future of underperforming options. There is a better way, and that way is through GTR. Thankfully, through skill, experience, and diligence, balancing market-crushing returns with a low relative risk profile is not the impossibility it first may seem. In this market, while practically everything is bleeding itself white GTR has maintained an unbroken string of green months and positive rewards streams to all of our contributors.

Since the project’s inception in November of 2021, our trading team has delivered market-beating rewards consistently, without unduly risking contributors’ capital. Our team has gamefully managed to outperform inflation as well. Rather than watching everything collapse, GTR NFT holders have reaped the benefits of high yield while simultaneously enjoying a position of strong capital preservation. At GTR, You no longer have to worry about your savings being eaten away by poor performance or inflation.

Even better, we can help you make up the difference.

Join Us

Please be sure to stay tuned to our social media outlets moving forward for updates and news of the Ghost Trader project. We invite you to check out our official Ghost Trader website, join us either on Telegram or Discord, follow us on Twitter and LinkedIn, and be sure to check out the podcast found here.